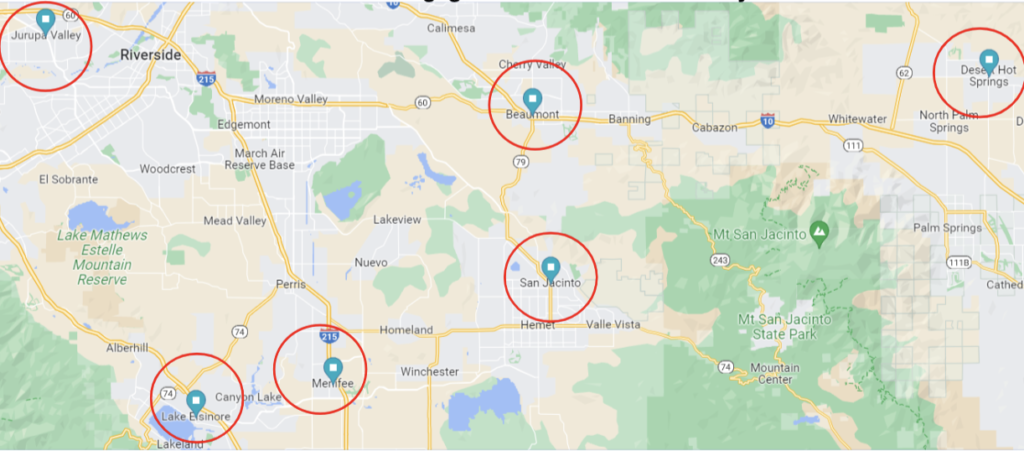

Urban Futures, Incorporated (UFI) covers all aspects of fiscal administration and capital financing/reporting needs for public agencies large and small. UFI’s Public Finance Group, staffed with Series 50 municipal advisors, supports the issuance of debt and capital lease financing with municipal advisory services. UFI’s Public Management Group, supports non-municipal advisory services including fiscal forecasts, continuing disclosure reports, and financial policy review and development. With offices in southern and northern California, UFI service offerings include long-range financial and budget forecasting, strategic funding options, capital financing and debt reporting services. What differentiates UFI from its peers is an innovative approach to providing comprehensive services, making UFI a “one-stop shop” for financial solutions. UFI has had numerous unique engagements in Riverside county over the past decade. In 2011, UFI participated in the incorporation team for the City of Jurupa Valley and UFI’s CEO, Michael Busch, served as the City’s first finance director. Other UFI staff served as administrative services department personnel for several years after the City’s incorporation. Additional unique work for cities in Riverside County has included the development of a complex financial workout plan for the City of Beaumont, various public facility financings, and servicing other financial administration needs within the region. Recent engagements demonstrate the value of UFI’s one-stop shop service offerings.

Recent UFI Engagements In Riverside County

Beaumont

Since 2015, UFI has assisted the City of Beaumont with a variety of public finance needs. UFI is pleased to announce its engagement with the City of Beaumont for municipal advisory and non-advisory services including a proposed financing of a proposed police facility and the development of a 10-year financial forecast. The scope of activities to be performed include:

• Identify and analyze financing solutions, bond structuring, and alternatives for funding the proposed police facility;

• Prepare preliminary cash flows for financing alternatives;

• Review City budgets, capital improvement plan, financial projections, financial policies, and other related financial information;

• Assist in analysis of potential leased assets;

• Evaluate and analyze credit considerations for financing alternatives; and

• Advise on timing and size of future new money borrowing(s).

Menifee

UFI’s Public Management Group was recently engaged by the City of Menifee to prepare a financial forecast to help the City in

assessing its overall fiscal health. Since incorporation in 2008, the City has grown 84% and is currently the fifth fastest growing city in California. The City currently has a population of over 105,000 and expects that number to increase to 150,000 residents within the next 24 years. UFI’s Public Finance Group has also been engaged to provide municipal advisory services to the City assisting City staff with the development of a long-term facilities development strategy to support operations into the future, which includes various facilities projects, including a new City Hall, Police Station, and Maintenance Operations Center.

UFI’s services will help the City align its fiscal capacity with its strategic objectives by evaluating long-term financial impacts of various service goals and capital projects; assess options to close funding gaps; and effectively communicate the City’s financial outlook/constraints and the trade-offs or actions required to achieve the community’s priorities. UFI is pleased to support the City on these milestone projects.

Lake Elsinore

UFI’s municipal advisor team is proud to support TheCity of Lake Elsinore’s Finance Team with their recent sale of $23.7 million of lease revenue bonds, generating $24.1 million in proceeds. The bonds were issued primarily to finance a new City Hall facility which will further enhance the City’s historic downtown and house City Council chambers, administrative office space, multi-purpose and retail space, and outdoor amenities with connection to the existing City Hall building. Prior to the issuance of bonds for city hall, UFI has served as a municipal advisor on over $200 million in CFD bonds, as well as the city’s highly successful Launch Point project (https://launch-pointe.com). Additionally, in 2018, UFI’s Public Management Group developed a long-term financial forecast model for the City and was recently requested to update the model for fiscal year 2023. As part of this update, UFI will migrate the City’s existing forecast model to the latest forecasting platform and update it with the City’s current financial data and the econometric data and variables. Lake Elsinore has been one of the fastest growing populations over the past decade in California, and the Nation. As a growing City, the Lake Elsinore will rely on the forecasting tool to predict the ever changing financial position of the City over the next ten years. The model will evaluate “what-if” scenarios, generate graphical outputs and statistical measurements to help tell the story of the City’s financial outlook, fiscal options and decision-making/stewardship in understandable terms.

UFI’s municipal advisor team is proud to support TheCity of Lake Elsinore’s Finance Team with their recent sale of $23.7 million of lease revenue bonds, generating $24.1 million in proceeds. The bonds were issued primarily to finance a new City Hall facility which will further enhance the City’s historic downtown and house City Council chambers, administrative office space, multi-purpose and retail space, and outdoor amenities with connection to the existing City Hall building. Prior to the issuance of bonds for city hall, UFI has served as a municipal advisor on over $200 million in CFD bonds, as well as the city’s highly successful Launch Point project (https://launch-pointe.com). Additionally, in 2018, UFI’s Public Management Group developed a long-term financial forecast model for the City and was recently requested to update the model for fiscal year 2023. As part of this update, UFI will migrate the City’s existing forecast model to the latest forecasting platform and update it with the City’s current financial data and the econometric data and variables. Lake Elsinore has been one of the fastest growing populations over the past decade in California, and the Nation. As a growing City, the Lake Elsinore will rely on the forecasting tool to predict the ever changing financial position of the City over the next ten years. The model will evaluate “what-if” scenarios, generate graphical outputs and statistical measurements to help tell the story of the City’s financial outlook, fiscal options and decision-making/stewardship in understandable terms.

San Jacinto

The City of San Jacinto is experiencing significant investments in residential and commercial development. Concurrently, the City has maintained its focus on long-term service sustainability. To achieve this objective, and to manage growth expectations, the City Council proposed Measure V, a 1% increase in Sales Tax, which was approved by 69.5% of the voters in November 2020. A portion of those funds are available to finance a new city hall facility. While funding needed for a new city hall facility is now secured, staff has engaged UFI’s Public Finance Group to provide municipal advisory services evaluating potential public facility development strategies including Lease-Leaseback, Progressive Design Build and traditional Design Bid Build aimed to fund recently acquired real property as a new city hall site, including retail and parking facilities in the downtown area.

The City of San Jacinto is experiencing significant investments in residential and commercial development. Concurrently, the City has maintained its focus on long-term service sustainability. To achieve this objective, and to manage growth expectations, the City Council proposed Measure V, a 1% increase in Sales Tax, which was approved by 69.5% of the voters in November 2020. A portion of those funds are available to finance a new city hall facility. While funding needed for a new city hall facility is now secured, staff has engaged UFI’s Public Finance Group to provide municipal advisory services evaluating potential public facility development strategies including Lease-Leaseback, Progressive Design Build and traditional Design Bid Build aimed to fund recently acquired real property as a new city hall site, including retail and parking facilities in the downtown area.

Desert Hot Springs

In January 2022, UFI served as the municipal advisor for the Desert Hot Springs Public Financing Authority’s issuance of $14.8 million Lease Revenue Bonds, Series 2022A, and $1.13 million Taxable Lease Revenue Bonds, Series 2022A-T. Proceeds of the bond issuances were used to finance the expansion of a new City Hall and Police Station. The City had been utilizing trailers for City Hall for over 10 years. Due to cost concerns of building a new City Hall, the City pursued financing the cost of converting its Visitor Center into a permanent City Hall which would save them up to $20 million. UFI’s Public Finance Group crafted a rating presentation in coordination with the underwriter that emphasized the City’s strong management team and Recovery Plan that had led to General Fund surpluses. S&P assigned an “A+” rating, which is a one notch upgrade from bonds issued just a few years prior. As a result, the City was able to achieve its goal of generating funds to begin the full construction on a much-needed new City Hall and expansion of its existing Police Station for its staff.

In January 2022, UFI served as the municipal advisor for the Desert Hot Springs Public Financing Authority’s issuance of $14.8 million Lease Revenue Bonds, Series 2022A, and $1.13 million Taxable Lease Revenue Bonds, Series 2022A-T. Proceeds of the bond issuances were used to finance the expansion of a new City Hall and Police Station. The City had been utilizing trailers for City Hall for over 10 years. Due to cost concerns of building a new City Hall, the City pursued financing the cost of converting its Visitor Center into a permanent City Hall which would save them up to $20 million. UFI’s Public Finance Group crafted a rating presentation in coordination with the underwriter that emphasized the City’s strong management team and Recovery Plan that had led to General Fund surpluses. S&P assigned an “A+” rating, which is a one notch upgrade from bonds issued just a few years prior. As a result, the City was able to achieve its goal of generating funds to begin the full construction on a much-needed new City Hall and expansion of its existing Police Station for its staff.