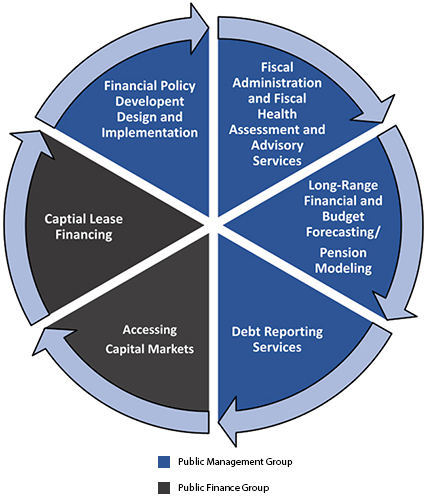

UFI’s Public Finance and Public Management Groups work together to cover all aspects of fiscal administration and capital financing/reporting needs for cities, counties, and special districts.

We have a dynamic and synergistic approach to everything we do. We provide an array of comprehensive financial services to California public agencies large and small that span the full spectrum of fiscal health. With offices in southern and northern California, UFI service offerings include long-range financial and budget forecasting, pension modeling, strategic funding options, capital financing and debt reporting services. What differentiates us from our peers is an innovative approach to providing comprehensive services, making UFI a “one-stop shop” for financial solutions and our ability to perform exceptional work of the highest standards where “good enough” is never good enough. Our associates have years of experience in all aspects of local government fiscal operations.

Public Finance Group

UFI’s Public Finance Group supports the issuance of debt and capital lease financing. We specialize in the following issuer and security types:

- COPs/Lease Revenue

- Capital Lease Financing

- Utilities

- General Obligation Bonds

- Tax Allocation Bonds

- Pension Obligation Bonds

- CFD/Assessment Districts

- Charter Schools and Universities

- Tax Increment

- Private Placement

- Public Private Partnerships (P3)

- EB-5

Public Management Group

UFI’s Public Management Group brings a dynamic blend of technical and practical approaches to public financial management and the disclosure and dissemination needs of California cities and public agencies. Our technical experience in financial modeling and analytics provides unique insights into revenues, expenses, liabilities, fiscal challenges, and strategic opportunities. UFI currently serves over 150 California cities, school districts, successor agencies, joint powers and financing authorities, and enterprise districts with post-issuance compliance services. In-house market sources such as Bloomberg, TM3 (Thompson Reuters) and EMMA help result in fast and accurate service delivery for our clients. Debt compliance and reporting services include:

- Financial Management Policy Development and Training

- Continuing Disclosure Reports

- Annual Debt Transparency

- Ratings Monitoring

- Arbitrage Rebate

Values

Commitment

UFI is committed to serving its clients with integrity, honesty, and with the public’s interest in mind. Our team is committed to building financially sustainable and stable local communities and agencies. UFI employs former City Managers, Finance Directors, analysts, and other public service finance professionals with years of experience in local government finance operations. As practitioners in the field, UFI colleagues have frontline experience that they bring to their work. We are proud of the work we do with the public sector.

Excellence

At UFI, talent management is an organizational priority and not an after-thought. We seek out high-performing talent because we see the value in finding and nurturing the right people to serve our clients’ mission. UFI is comprised of experienced professionals in the field of public finance with advanced degrees from top universities with established track records.

Passion

Our team has a passion for helping organizations fulfill its mission to serve the public good. UFI’s service delivery model is premised on the idea that good government starts with good people that have a passion for making a difference. There is a sense among UFI colleagues that the work they do in government is meaningful – and that’s what makes it so satisfying.

Results

UFI provides services and products that we feel are unmatched in our field, on time, within budget, and meeting the expectations of our clients. What makes us most proud, is designing services based on outcomes. Our technical experience provides unique insights and strategic opportunities. We marry these technical insights with our local government executive experience to formulate practical solutions that work in your policy context.

Urban Futures offers excellent career opportunities for individuals with the right combination of experience, skills, and character.

As one of the leaders in local government municipal advisory and fiscal administration services, Urban Futures regularly seeks qualified candidates for a variety of positions. If you are seasoned professional in municipal finance, are recently retired or expecting to retire and share our core values, UFI might be the place for you. We offer remote part-time and full-time employment opportunities in our Public Finance and Public Management Groups for those with at least ten years of increasingly responsible and professional public finance experience.

Candidates will not be managing staff, but instead performing the assigned work as an extension of our clients’ staff. We are looking for technically proficient and seasoned municipal advisors, public finance bankers, finance directors, budget or accounting managers, and senior analysts who can roll up their sleeves and provide direct technical and advisory support in an autonomous manner to our clients in any of the following areas:

- Financial planning and analysis associated with capital replacement plans including, debt capacity analysis, bond issuance and post issuance compliance of bonded debt;

- Develop and implement fiscal policies consistent with best practices and major rating agency input;

- Perform special projects and audits of financial management procedures and conduct fiscal analyses and studies;

- Utilize and practice principles and practices of governmental accounting and financial reporting; public treasury management; financial analysis, forecasting and long-term financial planning; public finance/debt administration; municipal revenue sources and fee analysis; and budget development and disbursement control;

- Analyze problems; conduct studies, identify alternative solutions, determine cost effectiveness of proposed solutions; project consequences of proposed actions and implement approved recommendations;

- Develop, analyze, interpret and implement financial management systems, procedures and reports;

- Perform detailed cost benefit and cash flow analyses for a variety of prospective projects, purchases, benefit programs, activities and financial strategies;

- Communicate clearly and concisely, both orally and in writing; and

- Prepare and articulately present recommendations/solutions using PowerPoint to elected or appointed boards, commissions, and committees.